This project is a high-frequency trading (HFT) system designed to capitalize on volatility in the cryptocurrency markets. It evolved from a simple Python scraper into a robust distributed system capable of processing market data in nanoseconds.

System Evolution#

1. Data Engineering Limitations#

I initially started with Python and PostgreSQL, but the sheer volume of tick data (Level 2 order books) created a bottleneck.

- The Pivot: Migrated to Golang for its raw performance and concurrency primitives.

- Storage: Switched to InfluxDB (Time Series Database) to handle millions of data points effectively without the write-lock overhead of relational databases.

2. Strategy & Analysis#

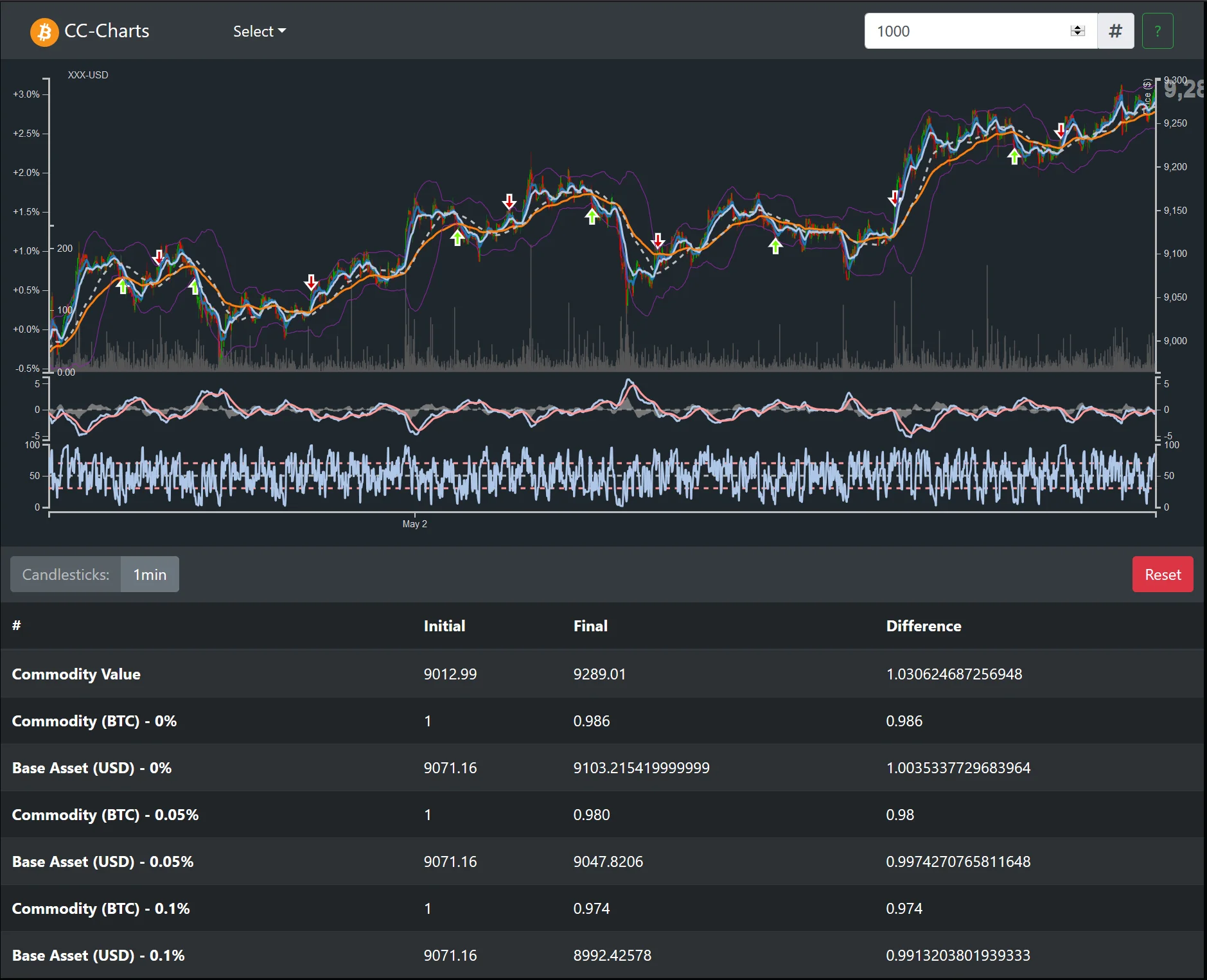

Accumulating a 40GB+ dataset allowed for rigorous backtesting.

- Pattern Matching: Implemented algorithms to detect arbitrage opportunities and specific “market maker” patterns.

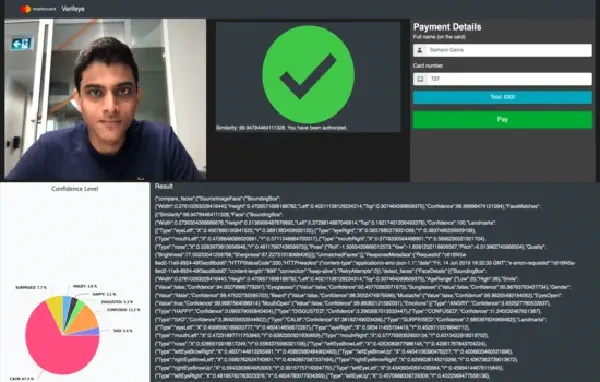

- Machine Learning: Utilized sentiment analysis and risk assessment models to filter trade signals.

- Performance: The bot achieved 0.5% weekly returns (net of fees) during the testing period.

Architecture#

The system is composed of nine specialized microservices communicating via a message bus.

- Ingestion: Co-located VPS instances near exchange servers to minimize network latency.

- Monitoring: Full observability stack using Grafana to track “Tick-to-Trade” latency and system health.

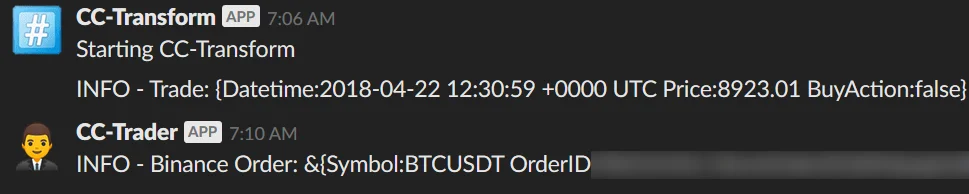

- ChatOps: Integrated with Slack to broadcast trade decisions and predictive signals in real-time.

Tech Stack:

- Language: Golang, Node.js

- Database: InfluxDB, MongoDB

- DevOps: Docker, Grafana, Promethus

- APIs: REST, WebSockets (Exchange Feeds)